Irs depreciation calculator

This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. Di indicates the depreciation in year i C indicates the original purchase price or.

Guide To The Macrs Depreciation Method Chamber Of Commerce

It is not intended to be used for.

. Depreciation recapture tax rates. Provide information on the. First one can choose the straight line method of.

NIIT is a 38 tax on the lesser of net investment income or the excess of modified adjusted gross income MAGI over the threshold amount. Next youll divide each years digit by the sum. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

Use this calculator to calculate an accelerated depreciation of an asset for a specified period. 100 bonus depreciation for 2022 new and used. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion.

7 6 5 4 3 2 1 28. This depreciation calculator is for calculating the depreciation schedule of an asset. The calculator also estimates the first year and the total vehicle depreciation.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical. 2022 IRS Section 179 Calculator - Depreciation Calculator - Ascentium Capital Section 179 Calculator Leveraging Section 179 of the IRS tax code could be the best financial decision you.

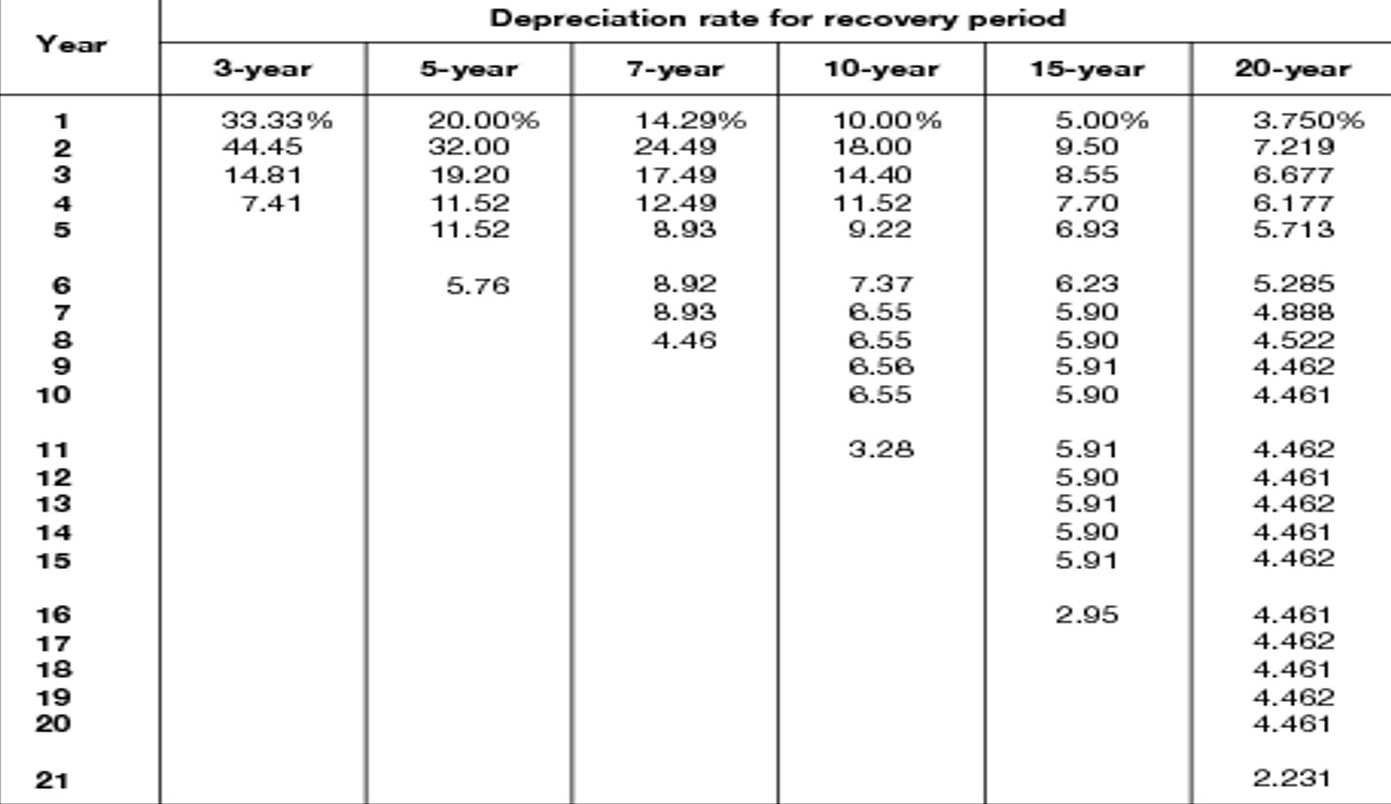

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. Calculator Use Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20.

Di C Ri Where. Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate the rate and expense amount for personal or real property for a given. The bonus depreciation calculator is proprietary software based on three primary components.

Also includes a specialized real estate property calculator. Net investment income may include rental. Make the election under section 179 to expense certain property.

A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the. This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

In other words the. It assumes MM mid. IRS Section 179 Deductions Highlights.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. The MACRS Depreciation Calculator uses the following basic formula. Most new and used equipment as well as some software qualify for the Section 179 Deduction.

Use Form 4562 to. Claim your deduction for depreciation and amortization. It provides a couple different methods of depreciation.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

Macrs Depreciation Definition Calculation Top 4 Methods

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Excel Finance Class 85 Macrs Depreciation Asset Sale Impacts On Npv Cash Flows Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Double Teaming In Excel

Automobile And Taxi Depreciation Calculation Depreciation Guru

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Macrs Depreciation Definition Calculation Top 4 Methods

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

The Mathematics Of Macrs Depreciation

Free Macrs Depreciation Calculator For Excel

Depreciation Macrs Youtube

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

Solved Depreciation Rate For Recovery Period Year 3 Year Chegg Com